Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

What Is Candlestick patterns?

Master the stock market and understand all candlestick patterns in English

In today’s article, we have told about complete candlestick pattern!

In this article, we have told in full detail about single candlestick pattern, double candlestick pattern and triple candlestick pattern. The article will be a bit long but if you read the article completely, then you will not need to read any other article after this.

The thin rod that is formed at the top of the candle is called week!

Candle is basically made of Week and Body!

Candlestick Pattern Are a Technical Analysis Tools that visually represent daily price movements on a Candlestick Chart in financial Market

You people must have generally seen two types of candles, one is red candle and the other is green candle. Green candle is formed when the price of the share increases, that is why it is called Bullish candle! And the second is red candle, which is formed when the price of the share starts falling!

That is why it is called Bearish Candle! But apart from this, we have to understand that there are two types of parts in a candle.

All Single Candlestick Pattern

Let us know about all single Candlestick patterns in detail.

Candlestick Pattern can be used in every kind of market.

Whether it is stock, index, crypto, option or future, candlestick pattern becomes very beneficial for you in any financial market. If you know the candlestick pattern, then your basic of technical analysis will become strong!

All Single Candlestick Pattern

1.Hammer Candlestick Pattern

2.Hanging Man Candlestick Pattern

3.Inverted Hammer Candlestick Pattern

4.Shooting Star Candlestick Pattern

5.Marubozu Candlestick Pattern

6.Spinning Top Candlestick Pattern

7.Doji And Long Legged Doji Candlestick Pattern

8.Dragon Fly Doji Candlestick Pattern

9.GraveStone Doji Candlestick Pattern

How To Read Candlestick Pattern?

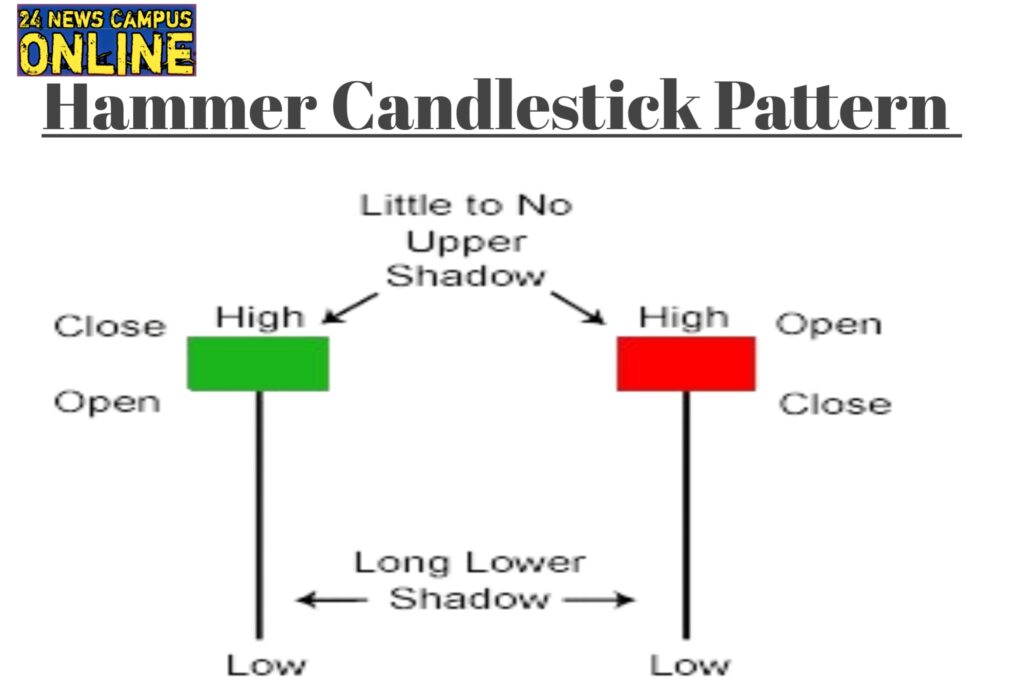

☆1.Hammer Candlestick Pattern:- This is Hammer Candlestick Pattern. The word Hammer in its name is not an abuse but it comes from hammer in Japanese and it is a Bullish Candlestick Pattern!

☆2.Hanging Man Candlestick Pattern:-

Hanging Man Candlestick Pattern is named after a person who is hanging. It is considered that a person is hanging, so it is called Hammer Candlestick Pattern and it is a Bearish Candlestick Pattern. After the formation of this Candlestick Pattern, the price of the share starts falling!

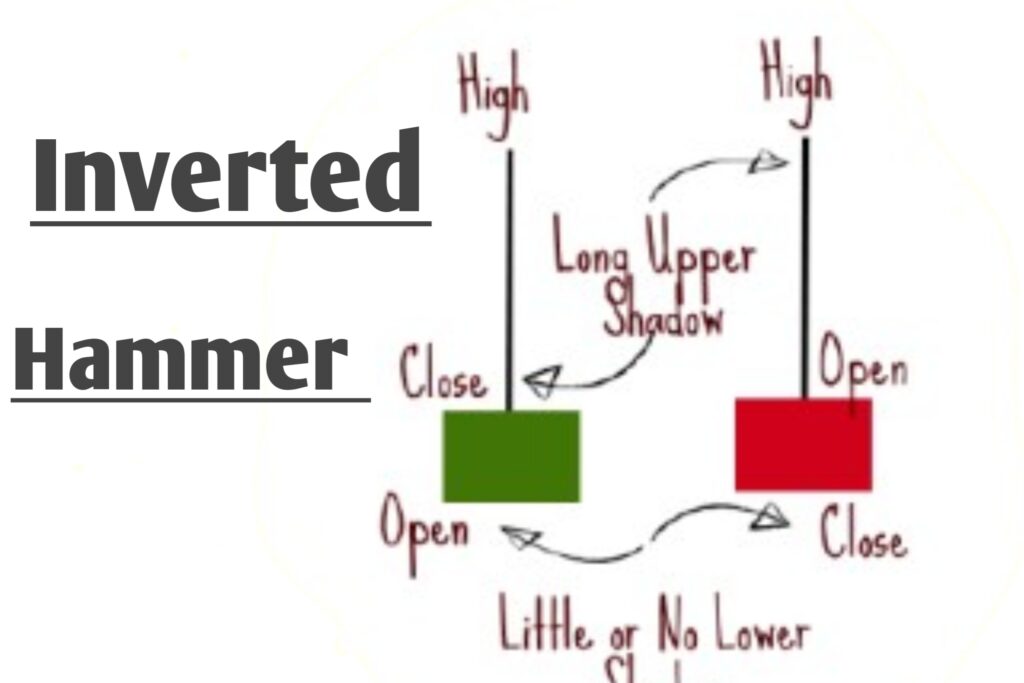

☆3.Inverted Hammer Candlestick Pattern:-

The word Inverted hammer in its name means an upside down hammer and it is a Bullish Candlestick Pattern! After the formation of this candlestick pattern, there is a chance of increase in the share price

☆4.Shooting Star Candlestick Pattern:-

This Shooting Star candlestick pattern looks like an Inverted Hammer, the only difference is that in the Inverted Hammer, the share price is falling downwards and in the Shooting Star pattern, the share price is rising first. Shooting Star candlestick pattern is a Bearish candlestick pattern! After the formation of this candlestick pattern, there is a chance of the share price falling! And the Inverted Hammer candlestick pattern is a Bullish candlestick pattern!

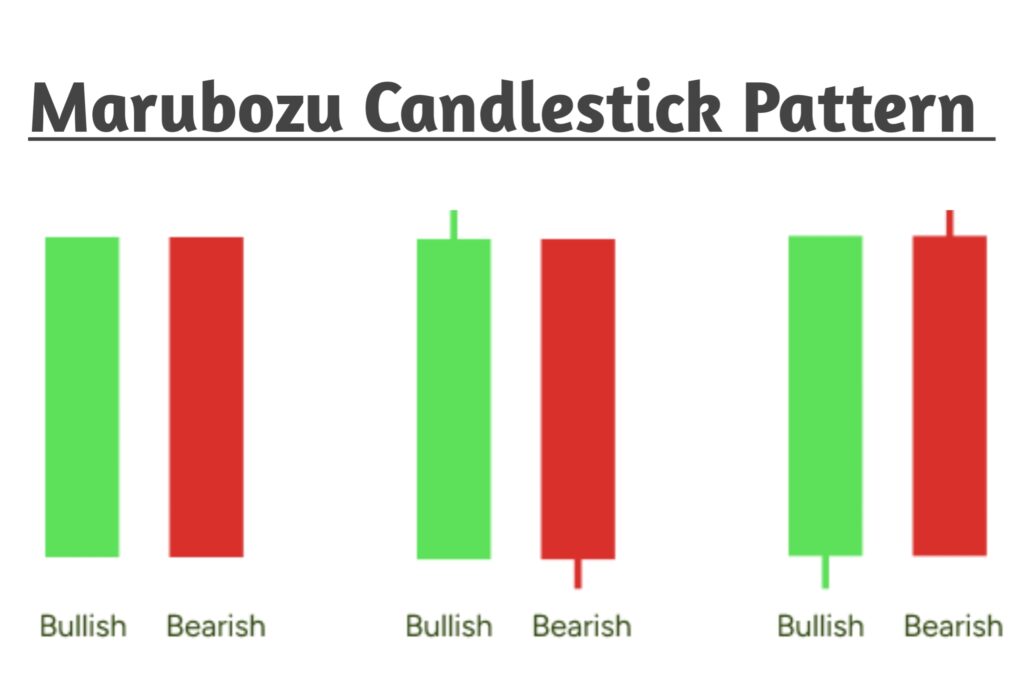

☆5.Marubozu Candlestick Pattern:-

Marubozu Candlestick Pattern is of two types!

First Bullish Marubozu Candlestick Pattern Second Bearish Marubozu Candlestick Pattern

This is called Marubozu! This name is called Takla in Japanese!

This Marubozu candlestick pattern is not weak when it is formed, if it is green then it is Bullish Candlestick Pattern! And if it is red then it is Bearish Candlestick Pattern!

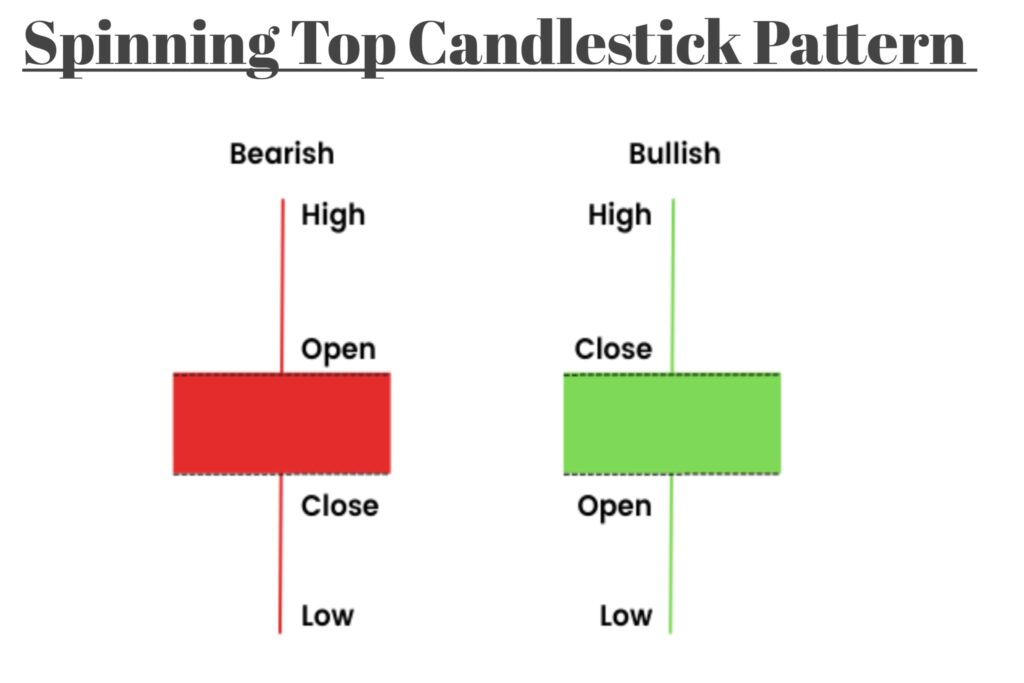

☆6.Spinning Top Candlestick Pattern :- Spinning Top Candlestick Pattern means Laddu, so this candlestick pattern! It looks like a top and this candlestick pattern is also of two types

First BULLISH SPINNING TOP Second BEARISH Spinning Top It looks like a top, that is why it is called Spinning Top!

If the share price is formed in down trend then it is a Bullish candlestick pattern. If the share price is formed in up trend then it is a Bearish candlestick pattern.

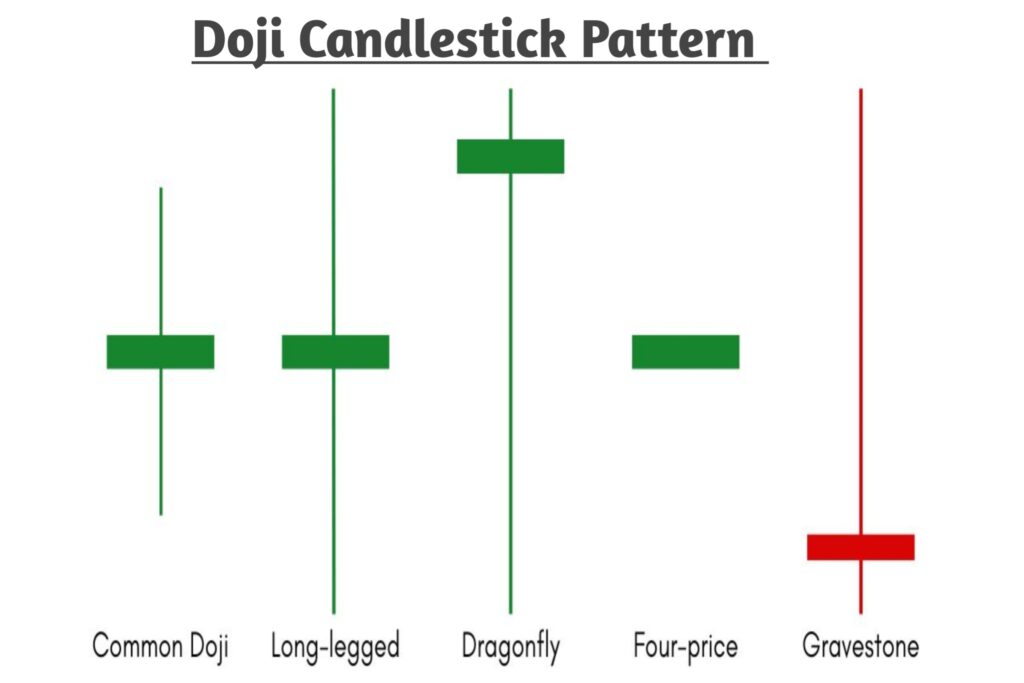

☆7.Doji candlestick pattern and/8.Long Legged Doji Candlestick Pattern:- This Doji candlestick pattern looks exactly like a Spinning Top but the only difference is that the body of the Spinning Top is a little bigger than that of Doji. The body of Doji is very small and its leg is very long.

That is, if the body of the Bullish Spinning Top becomes smaller then it becomes a Bullish Doji and if the body of the Bearish Spinning Top becomes smaller then it becomes a Bearish Doji.

The Bullish candle becomes green and the Bearish candle becomes red.

☆9.Dragon Fly Doji Candlestick Pattern:- This candlestick pattern is something like this T that you will see in the chart

If a candle like T is seen, then it is called Dragon Fly Doji!

This is a Bullish candlestick pattern! After the formation of this candlestick pattern, there is a chance of increasing the price of the stock! This candlestick pattern is formed in a down trend!

☆10.GraveStone Doji Candlestick Pattern:- The stone placed on top of the GRAVE is called Grave Stone Doji candlestick pattern!

This GraveStone Doji candlestick pattern is just opposite to Dragon Fly, meaning it is formed upside down! The train that is formed in GraveStone Doji is formed in the Up train!

This is a Bearish candlestick pattern, after the formation of this candlestick pattern, the price of the stock starts falling down!

And with this I have covered all the Single Candlestick Patterns! Now the second part will be about the Double Candlestick Pattern. So let’s know about the Double Candlestick Pattern

In today’s article, we will talk about all the Double Candlestick Patterns in detail, stay till the end

So let’s start with the Double Candlestick Pattern first

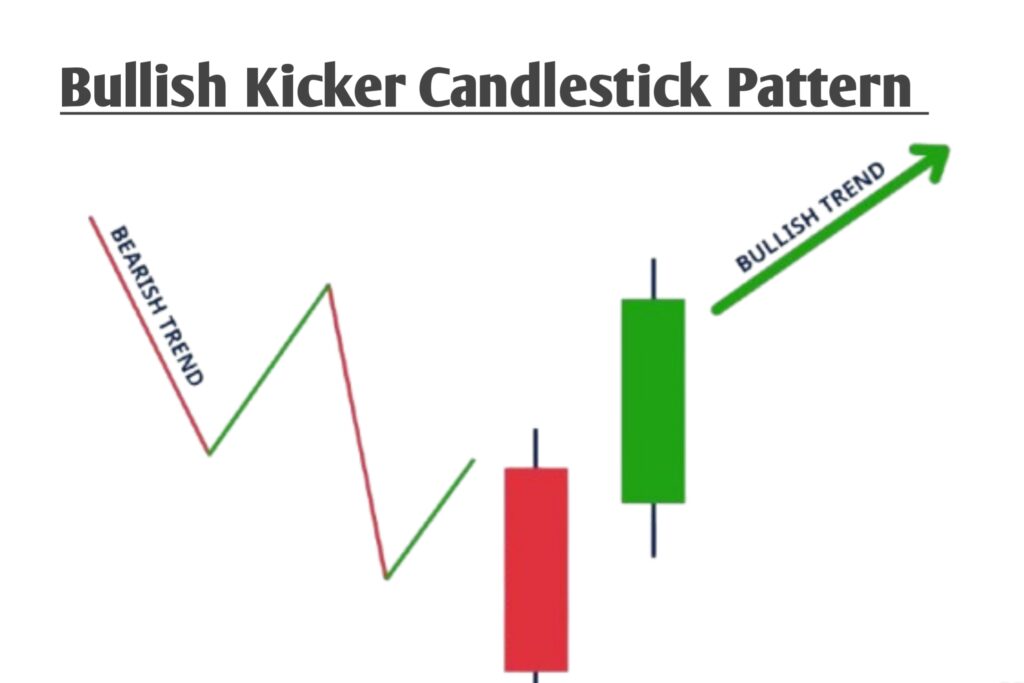

1.Bullish Kicker Candlestick Pattern:-

This Bullish Kicker Candlestick Pattern, from its name itself you can understand that it is a Bullish Candlestick Pattern, that is, after its formation, there is a chance of the stock price increasing!

Kicker is coming in its name itself, kick, you people are understanding that Kick means to hit five, it is absolutely correct, you are understanding correctly, Kick means to hit, to kick

For this Bullish Kicker candlestick pattern to be formed, first of all the stock should be in downtrend i.e. the price of the share should be falling and after this the first candle should be red and this candle should be gap up opening

Like after a red candle is formed, there should be a gap in the middle and after that a green candle should be formed, only then it will be called Bullish Kicker Candlestick Pattern

For the formation of Bullish Kicker Candlestick Pattern, it is very important to have Gap Up!

2.Bearish Kicker Candlestick Pattern:-

After the formation of Bearish Kicker Candlestick Pattern, there is a chance of the share price falling!

When the Bearish Kikar Candlestick Pattern is formed, the most important condition in this is that it should be formed in Up Trend and after this a very big green candle should be formed, after that a red candle should be formed because this is a Bearish Kicker Candlestick Pattern, so it is necessary to have a gap down opening.

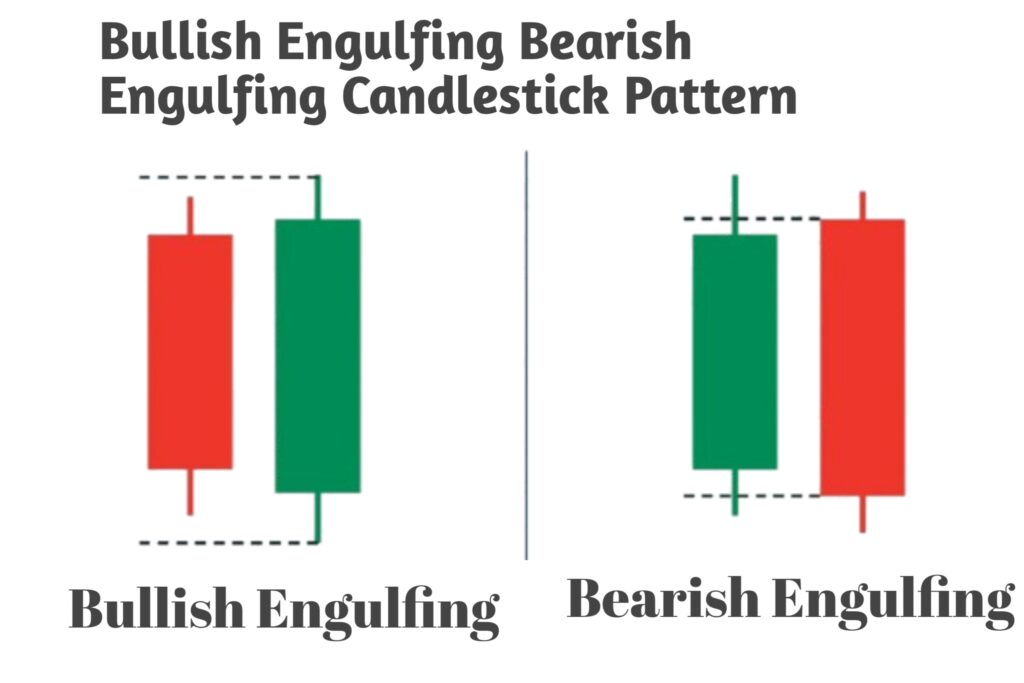

3.Bullish Engulfing Candlestick Pattern:- After the formation of Bullish Engulfing Candlestick Pattern, there is a chance of the share price increasing! Because for the formation of this candlestick pattern, the share price should be formed in the down trend, mostly the share price of the Bullish candlestick pattern is mostly in the down trend!

Engulfing means covering, so the candlestick pattern formed in this should completely cover the previous candle, that is, the red candle should be small, that is, it should be medium and the green candle should be large, so it is called Bullish Engulfing Candlestick Pattern!

4.Bearish Engulfing Pattern:- This is just the opposite of the Bullish Engulfing candlestick pattern. The share price should be in the Up Trend. After that, the first candle that will be formed will be a medium green candle. After that, a large red candle will be formed. In this way, a Bearish Engulfing candlestick pattern will be formed.

This red candle that will be formed will completely cover the green candle. That is why it is called Bearish Engulfing Candlestick Pattern. And after its formation, there is a chance of the share price falling.

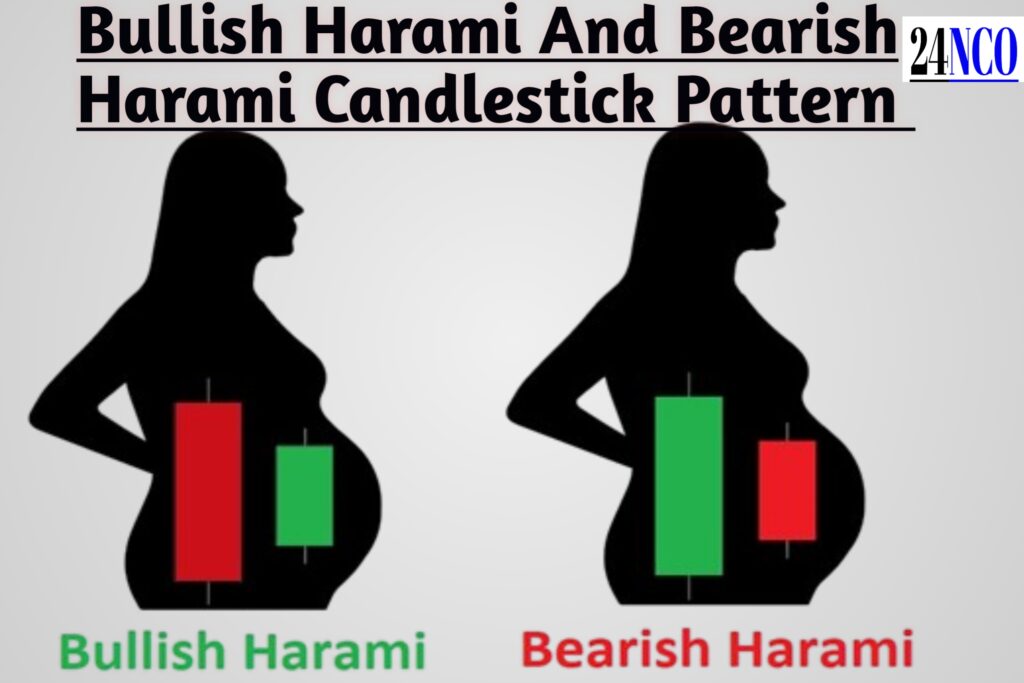

Bullish Harami Candlestick Pattern:- You must have understood the meaning of Bullish that this is a Bullish Harami candlestick pattern.

This Harami does not mean abuse. It means a pregnant woman. This candlestick pattern is a Japanese candlestick pattern. Harami means pregnant woman in Japanese.

In this candlestick pattern, the share price should first be in the down trend.

In this, a big bull candle is formed, after this a green candle is formed which is formed inside the body of the bull candle. Green candleAfter the formation of this candle, there is a chance of the share price increasing!

Why is it called Bullish Harami candlestick pattern because just like a pregnant woman keeps children in her stomach, in the same way this bull candle keeps the green candle inside it, that is why it is called Bullish Harami candlestick pattern!

5.Bearish Harami Candlestick Pattern:- Just opposite to Bullish Harami Candlestick Pattern is Bearish Harami Candlestick Pattern!This Bearish Harami Candlestick Pattern is formed in the Up train, in this the earlier Bullish Candlestick pattern was being formed in the Down train but this one is being formed in the Up train, so its name is Bearish Harami Candlestick Pattern,

so you can understand that after its formation, there is a chance of the share price falling!In this, first of all a big green candle is formed, after this a medium rate candle is formed, which is a medium rate candle inside the body of the green candle, in this the big candle is a woman and the small candle is a baby!

As soon as this pattern is formed, after its formation there is a chance of the share price falling!I am saying every time that there is a chance, I am never saying that it will fall every time

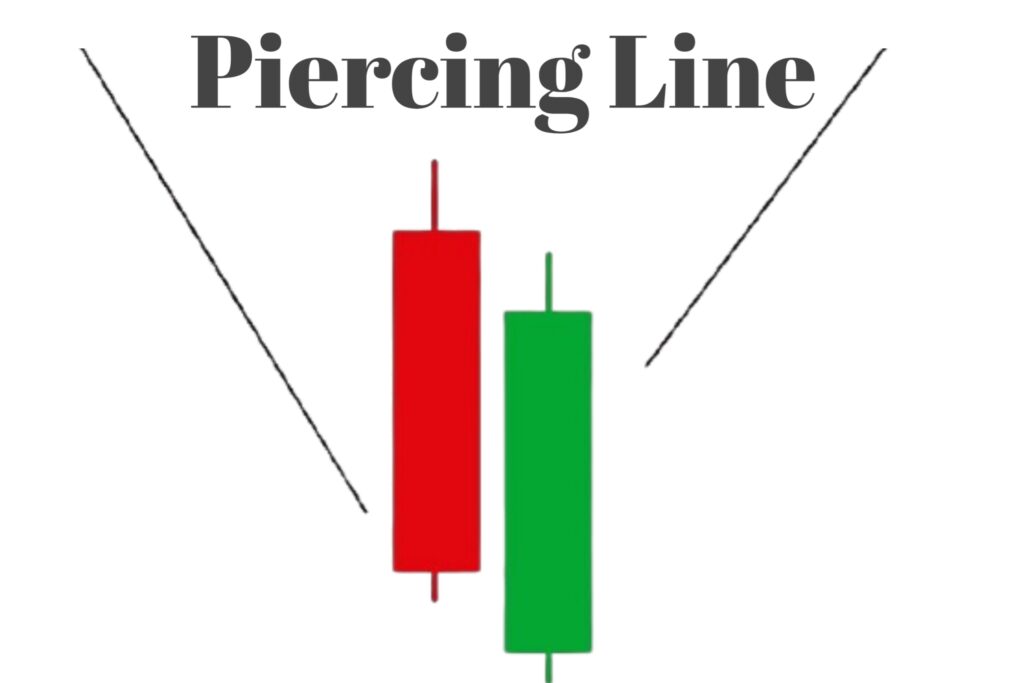

6.Piercing Line Candlestick Pattern:-

This is a bullish candlestick pattern!That is, after the formation of this pattern, there is a chance of the share price increasing! And it is formed in the downtrend!That is, before this the share price is falling! After that our first candle which is formed is a big rate candle! After that the second candle which is formed is a green candle!But the condition here is that after the formation of this red candle, the green candle that is being formed should open below the rate candle and the close of this red candle should be half

i.e. above 50% of the green candle, so this means that it is a Piercing Line Candlestick Pattern!

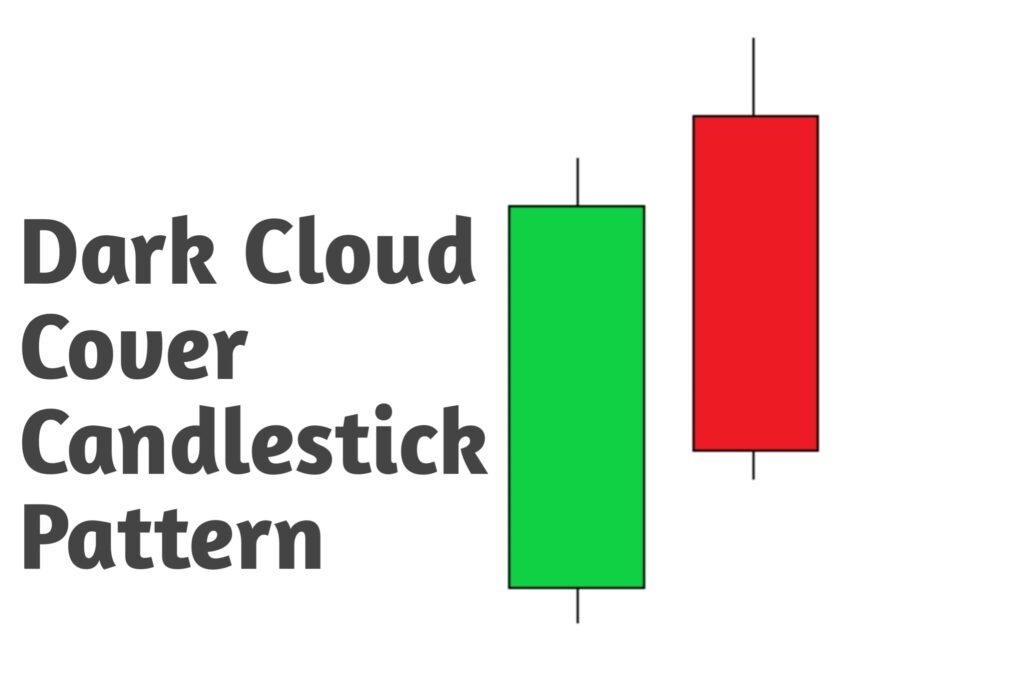

☆7.Dark Cloud Cover Candlestick Pattern:-

This Dark Cloud Cover Candlestick Pattern is just the opposite of the Piercing Line Candlestick Pattern! Where the Piercing Line was a Bullish Candlestick Pattern, the Dark Cloud Cover Candlestick Pattern is a Bearish Candlestick PatternIn this, first of all the price of the stock is in Up Trend, after that a big Green Candle is formed and after that the Next Candle is a Red Candle! And after its formation, there is a chance of the share price falling!

So this is called Dark Cloud Cover Candlestick PatternWith this candlestick pattern, we have told about all the double candlestick patterns

This is part 3 of complete candlestick patterns in English and it includes all triple candlestick patterns like Morning Star, Evening Star, Bullish Abandoned Baby, Bearish Abandoned Baby, Three White Soldiers, Three Black Crows, Bullish Three Line Strike, Bearish Three Line Strike, Three Inside Up and Three Inside Down candlestick patterns.24NCO Complete Guide to

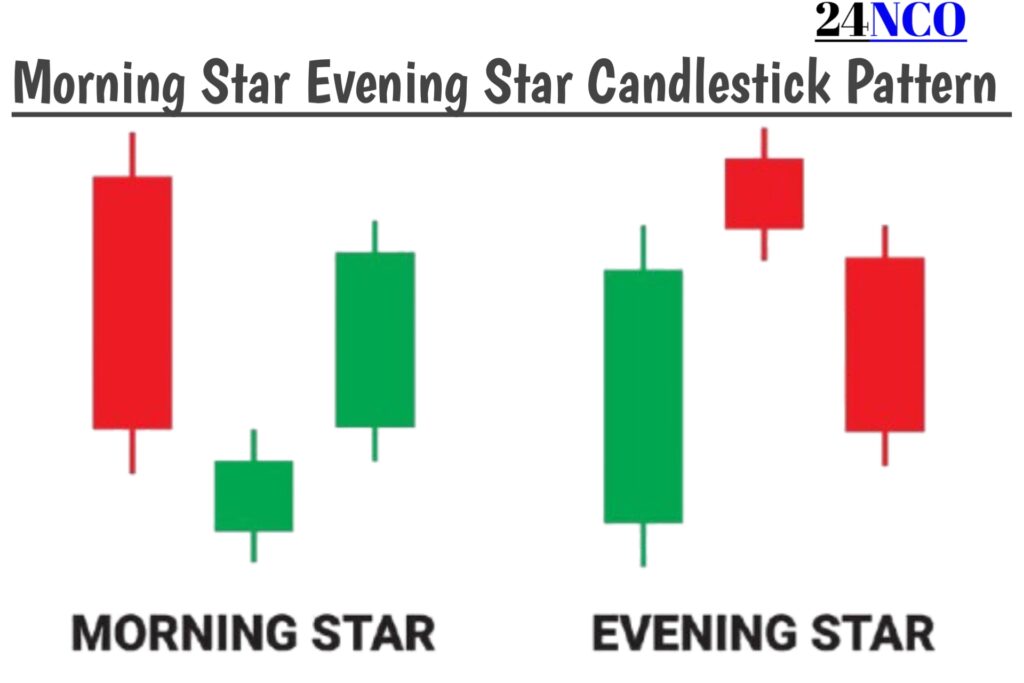

1.Morning Star Candlestick Pattern:-This Morning Star Candlestick Pattern is a Bullish Candlestick Pattern!After the formation of this pattern, there is a chance of the share price increasing.Whenever this Morning Star candlestick pattern is formed, you people will understand that now the share price will increase from here.I have told in the article on double candlestick pattern that any bullish candlestick pattern is generally formed in the down train, so this Morning Star candlestick pattern is also formed in the down train and it is a triple candlestick pattern!

In the Morning Star Candlestick Pattern, the first candle will be a long red candle and after this a very small green candle or red candle is formed and our third candle will be a big green colored candle.But the condition here is that the third candle that is formed should be formed with a gap up opening, only then we will call it Morning Star candlestick pattern!And let me also tell you the reason behind its name Morning Star, the reason behind this is that the middle candle in it is very small and sometimes it is like Doji, that is why it is named Morning Star Candlestick Pattern!

2.Evening Star Candlestick Pattern? Evening Star Candlestick Pattern which is a Bearish Candlestick Pattern, after the formation of this pattern there is a chance of the share price falling! And most of the Bearish Candlestick Pattern is formed in Up TrendIn the Evening Star Candlestick Pattern, the first candle that should be formed should be a big green candle, after that the second candle should be formed, it should be a very small red candle or it can also be like Doji! And after this, our third candle should be a big rate candle which should be formed with a gap down opening, only then we will call it the Evening Star candlestick pattern.

But the most important thing in this is that the third candle which is being formed after the second candle should have a gap down opening. The middle candle in this is considered a star because after its formation, there is a chance of the stock market price falling, so this is the Evening Star candlestick pattern!

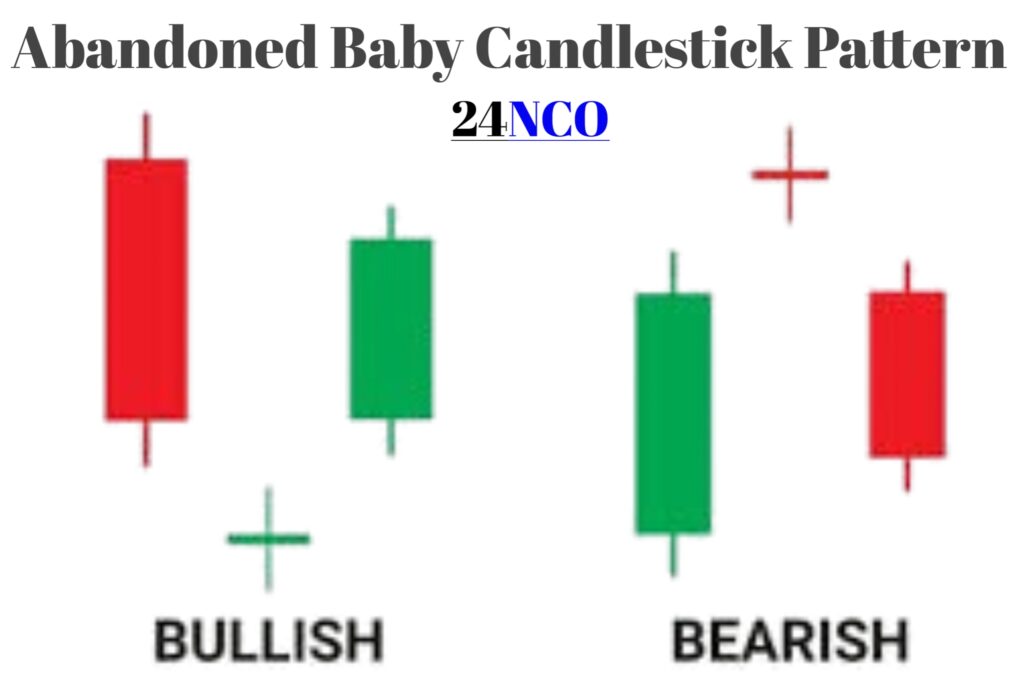

3.BULLISH ABANDONED BABY Candlestick Pattern :-Bullish ABANDONED Baby, you can understand from its name that it is a Bullish candlestick pattern because it is formed in the down train, you must have understood thisThree types of candles are formed to form the Bullish Abandoned Baby Candle, it must be looking like a Morning Star candlestick pattern

To you because the way the first rate candle is formed in the Morning Star, in the same way, in this also the first candle is a big rate candle, after this the second candle which is formed does not have any importance of color, it can also be of red color, green color can also be formed or it can be like Doji!

And after this the third candle which is formed should be a big green candle.Morning Star Candlestick Pattern Bullish Candlestick Pattern which was also a Bullish Candlestick Pattern, it was also formed in the down train, it is also formed in the down train!Now what is the difference between these two?

The only difference is that in our Bullish Abandoned Baby Candlestick Pattern, the middle candle looks like a Doji Candle!The only difference is that there is a big gap between the first candle and the third candle, so this is a Bullish Abandoned Baby Candlestick Pattern

4.Bearish Abandoned Baby Candlestick Pattern:-Bearish Abandoned Baby which is exactly similar to the Evening Star Candlestick Pattern, you know that the Evening Star Candlestick Pattern was a Bearish Candlestick Pattern and this is also a Bearish candlestick patternYou know that when a Bearish Candlestick Pattern is formed, it is formed in an Up TrendIn our Evening Star Candlestick Pattern,

The first candle was green and in this too the first candle is green!And the second was a small candle, it does not matter what color it is! And after this the third candle should be a big red colored candle which is very similarThe only difference in this is the gap which disappears in the Evening Star candlestick pattern.

It is a little less whereas in the Bearish Abandoned Baby candlestick pattern the gap is more.That is why it is called Bearish Abandoned Baby candlestick pattern!

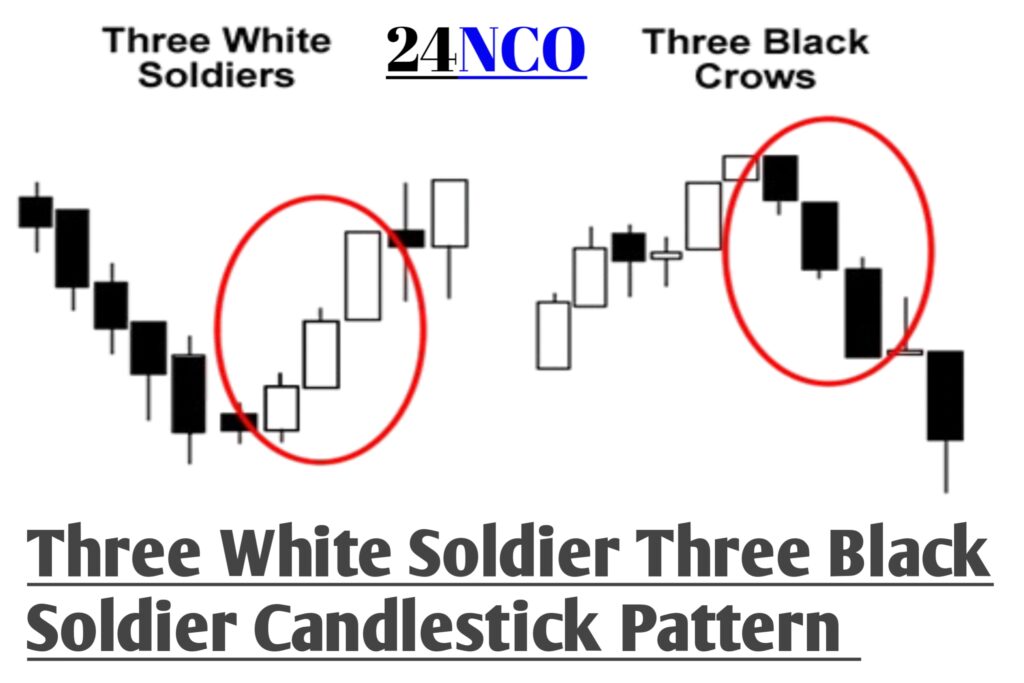

5.Three White Soldiers Candlestick Pattern? THREE WHITE Soldiers is a bullish candlestick pattern, that is, after the formation of this pattern, there is a chance of the share price increasing and this candlestick pattern is formed in the downtrend!

If we talk about this candle, then first a green candle is formed in it, after that a second big green colored candle is formed and after that a third big green colored candle is formed, that is, this is Three White Soldiers, in this all the three candles are green candles and they are big candles and the most important thing here is that the second candle formed in it should be above the first candle! These three candles should close on top of each other, only then it will be called Three White Soldiers Candlestick Pattern

And its name is three white soldier because you will see green and red color chart but there is also a chart of white and black color in which the green candle is a white colored candle and the red colored candle is a black colored candle Here three big green colored candles are being formed which are white colored in Black and White Chart, so it is called Three White Soldiers Candlestick Pattern

6. Three Black Crows Candlestick Pattern? This 3 Black Crows Candlestick pattern is a Bearish Candlestick Pattern!In this 3 Black Cross candlestick pattern, all three candles are red colored!If we talk about candles, then first a red candle is formed in it, the next red colored candle should close below it and the candle after it should also close below the previous candle.Whenever such a pattern is formed, then you can understand that it is a Three Black Crows candlestick pattern!

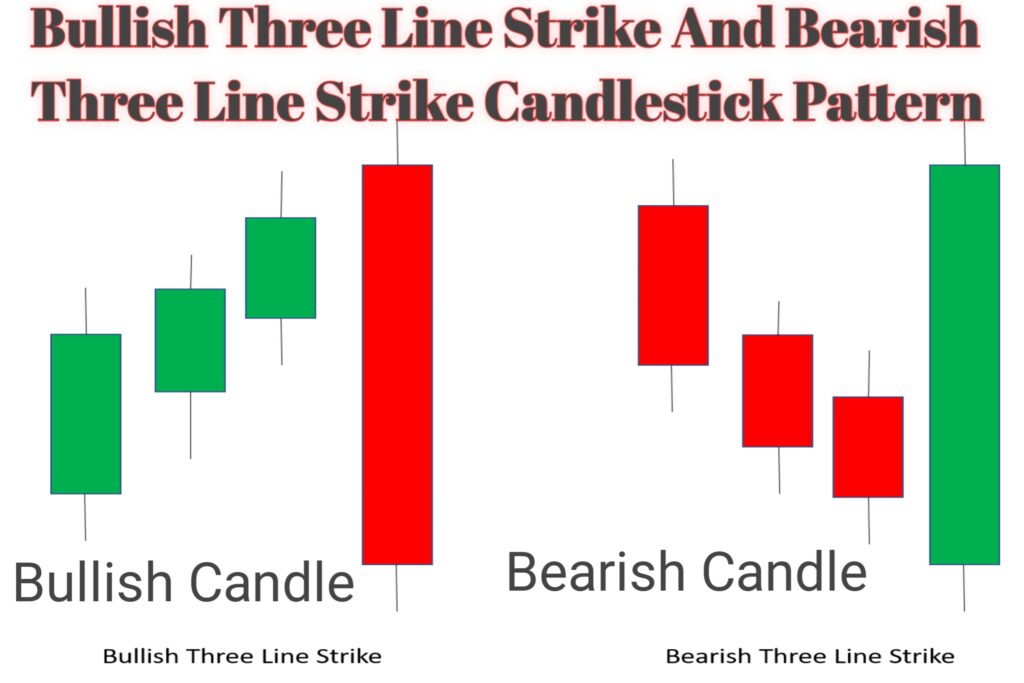

7.Bullish Three Line Strike Candlestick Pattern:-Bullish three line Strike, from its name itself you must be understanding that it is a Bullish candlestick pattern.It looks exactly like three white soldiers!Three Line Strike And Three White soldier’s Candlestick Pattern,

Both of these are the same, the only difference is that in Three Line Strike, after the formation of these three green candles, a big red candle is formed!After the formation of this pattern, there is a chance of the share price increasing!

8.Bearish Three Line Strike Candlestick Pattern :-This is just the opposite of Bullish Three Line Strike Candlestick PatternIn this, first three red candles are formed and after this a big green candle is formed. When this type of pattern is formedThen we consider it Bearish Three Line Strike Candlestick Pattern!From its name itself you people are understanding that this is Bearish Three Line Strike Candlestick Pattern! So after the formation of this pattern, there is a chance of the share price falling

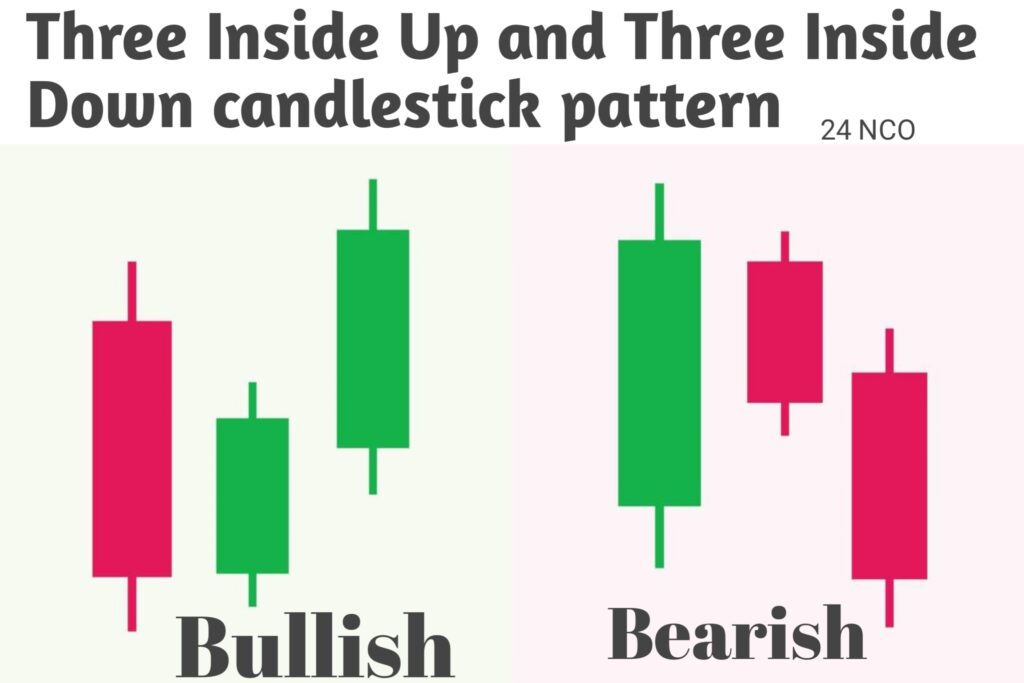

.9.Three Inside Up Candlestick Pattern:-Three Inside Up Pattern means after the formation of this pattern, there is a chance of the share price increasing.And you people know that Bullish candlestick pattern is mostly formed in the down trend.In this candlestick pattern, first a red candle is formed, after this a green colored candle is formed which is formed inside the body of our bullish candle and after this a third green colored candle is formed which closes above the second green candle!When this type of pattern is formed, we call it Three Inside Up Candlestick Pattern!

10.Three Inside Down Candlestick Pattern:-Three Inside Down candlestick pattern means after the formation of this pattern, there is a chance of the share price falling! And this is a Bearish Candlestick Pattern!And Bearish Candlestick Pattern is formed in Up Trend!

If we talk about candles, first of all a green candle is formed in it, our second candle is a red colored candle which is formed inside the body of the green candleThis is like a Bearish Harami Candlestick Pattern! The green colored candle in it is Mother and the red candle is Baby CandleBoth these candles together form a Bearish Harami Candlestick PatternThis already gives a Bearish signal and its third candle is a red candle which closes below the candleSo it is called Three Inside Down candlestick pattern!

And after the formation of this pattern, there is a chance of the share price falling!With the completion of candlestick patterns, we have read about a total of 30 candlestick patterns! In which we explained about 10 candlestick patterns in full detail in the first! In the second, we explained about 10 double candlestick patterns in full detail! And in this third article, we have told you about 10 triple candlestick patterns in full detail.

So now you can easily understand about candlestick patterns by reading the entire article.In the first paragraph, we have told about single candlestick pattern! In the second paragraph, we have told about double candlestick pattern and in the third paragraph, we have told about triple candlestick pattern.

If you want to remember it well! I would recommend you guys that if you read our candlestick patterns once again with a deep and true heart, then you will remember everything well and will also understand it! So, read these three articles once again, it will make your mind clear.

Everything will fit in properly, it will take only a little of your time, the learning you will get by reading this will be useful for your lifetime.

Read More-https://24newscampusonline.com/what-is-technical-analysis-basic-to-advance/

Conclusion:- In this article, we have told about the entire candlestick pattern, if you people take out your valuable time and read and understand this candlestick pattern once, then you will not have any problem in understanding the candlestick pattern in the stock market. Single Candlestick Pattern, Double Candlestick Pattern, Triple Candlestick Pattern have been explained in detail, if you people do trading and investing in the stock market, then first understand all the candlestick patterns in detail, read them, practice in the market, only then enter the field of trading or investing, thank you